Cutting Through the Noise

January 18, 2012

Early last year we published a report on how to assess your portfolio’s performance. The paper laid out a framework for evaluating your investments, focusing on five areas: gathering the facts, reviewing the market environment, analyzing the numbers...

Read MoreJanuary 5, 2012

As we start a fresh new year, there’s no shortage of Top 10 Lists (we’re guilty, too). They can get annoying and repetitive, even for a David Letterman fan. But some are worthy of passing on, even posting on the fridge. Here’s one you should staple to the front...

Read MoreSeptember 21, 2011

I was talking with a client last week about portfolio re-balancing and the challenges of volatile markets. I often tell the story of Bob Hager’s shaking hand to illustrate how hard it is to do the right thing when markets are down, but his story is just as good at bringing the...

Read MoreAugust 26, 2011

It was announced this week that Vanguard will start in Canada with 6 ETFs. In response to the news, blogger Michael James expressed disappointment that the 2 foreign equity funds would be hedged back into Canadian dollars. I wholeheartedly agree with his view.

Read MoreAugust 25, 2011

Tom was on BNN this morning discussing how we think about asset allocation and portfolio positioning in volatile markets. It’s all about being ‘approximately right’ rather than exactly wrong. In other words, you’re never going to pick the top or bottom of...

Read MoreAugust 10, 2011

What are the stock market declines telling us (other than we’re temporarily poorer)? Are they signaling the end of the world as we know it or, as a veteran value manager suggested to me yesterday, are we entering “opportunity-laden times?” In my view...

Read MoreAugust 5, 2011

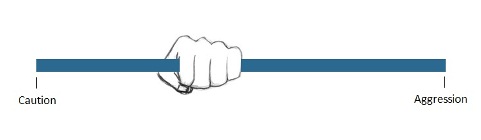

The Grip, which is our tool for expressing our overall portfolio strategy, was a new feature in the June Quarterly Report, but the cautious stance it signaled was not. Since January, we’ve recommended that clients be positioned conservatively and where...

Read MoreApril 27, 2011

In this space, we’ve talked often about the conundrum cash-rich investors face. If they’ve been out of the market, or are sitting on a high proportion of cash, what do they do? This week there were some comments from Earl (the Pearl) Bederman at Investor...

Read MoreFebruary 25, 2011

As an addendum to my post last week, I want to revisit the words safe and Canada. An excellent reason for investing in Canada is that it’s a safe(r) way to play the emerging markets, specifically China. Our resource stocks in particular will benefit from...

Read MoreFebruary 14, 2011

As for my strategy, I’ve sold some of my non-registered investments and invested the proceeds in my Steadyhand TFSA. I triggered a small capital gain in the process, but the future tax-free growth will more than offset the small tax liability. All of my TFSA...

Read MoreFebruary 7, 2011

The manager of our fixed income funds (Connor, Clark & Lunn) prepares a Financial Markets Forecast every year that addresses the outlook for the economy, inflation, monetary policy, market valuations and extreme technical conditions in order to set...

Read MoreJanuary 20, 2011

Assessing your portfolio’s performance is a key element of being a successful investor. Yet, it’s also one of the ‘muddiest’ and more overlooked areas of investing. That’s because a proper performance assessment takes time and is hard to do. Also, the...

Read MoreDecember 22, 2010

Howard Marks of Oaktree Capital Management is one of my favourite market analysts. In a letter published last Friday, he takes on the topic of gold. It’s a wonderful piece and a must read for anyone who is interested in the shiny metal. There are too many pearls...

Read MoreDecember 17, 2010

Our funds paid out their distributions to unitholders yesterday. As a reminder, distributions represent the mechanism whereby the funds transfer to unitholders any interest and dividend income and realized capital gains they accrued over the year...

Read MoreNovember 18, 2010

My posting last week (A Simple Risk Management Tool to Avoid the Next Bubble) garnered lots of comment. In one of the kinder emails, a reader asked what weaker performing assets I would consider to be an attractive balance to the current high flyers...

Read MoreNovember 8, 2010

Last week a friend asked me what his daughter should do with her mortgage. The bank was giving her the option of going with a variable rate mortgage at 2.85% or a 5-year fixed at 3.5%. Investment professionals get asked this question all the time by friends...

Read MoreOctober 18, 2010

“I’ve been shaking all night long, but my hands are steady” - from ‘Three Pistols’ by the Tragically Hip. David and I have been doing presentations over the last few weeks and we’ve talked about the notion of a ‘steady hand’. The company name came...

Read MoreSeptember 28, 2010

Through the market’s ups and downs over the last few years, one area of stability has been dividends (for investors in Canadian stocks at least). With few exceptions, companies have maintained or increased their dividend payouts, providing...

Read MoreSeptember 24, 2010

Writing about the unfairness of closed-end funds has been a lonely vigil. Despite the fact that the last year has been a robust period for new issues of these funds, there have only been a few other commentators taking on this egregious industry practice. In...

Read MoreSeptember 16, 2010

We continue to be barraged with negative news. Even the most positive economists are projecting slow growth for the next few years, and the bearish ones, whose names all seem to start with ‘R’, send chills down my spine. One sentence in Connor...

Read MoreAugust 30, 2010

t was reported this week that millionaires are feeling more bearish. The Spectrem Millionaire Investor Confidence Index fell to -18, which represents “mildly bearish territory”. Prior to the August score, the index had been in neutral range (-10 to +10)...

Read MoreAugust 18, 2010

Flashback to February 2007. It was the middle of RRSP season and Tom Bradley penned a Globe and Mail article that would, in turn, prompt numerous investors and advisers to share stories of their RRSP nightmares. How many funds do you...

Read MoreAugust 12, 2010

This week’s rerun comes from April 2009. The stock market had recently bottomed and investors were particularly fearful of risk. Not surprisingly, investment products with special features that promised certainty or limited downside were gaining...

Read MoreAugust 3, 2010

In this week’s rerun we flip the calendar back to September 2007. The loonie had recently hit parity with the U.S. dollar for the first time in over 30 years. Predictions were widespread on which direction it was headed next. As for our forecast? (see the last...

Read MoreJuly 20, 2010

In this week’s rerun, we revisit the asset backed commercial paper (ABCP) debacle as a reminder of a key lesson in investing – if you don’t understand what you’re getting into, don’t buy it. Purdy, what were you thinking? Didn't you know how complex and...

Read More