In this week’s rerun we flip the calendar back to September 2007. The loonie had recently hit parity with the U.S. dollar for the first time in over 30 years. Predictions were widespread on which direction it was headed next. As for our forecast? (see the last paragraph) We were almost bang on; the Seahawks won 24-21.

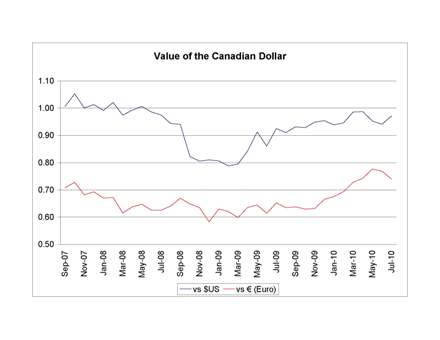

Interestingly enough, the Canadian dollar today is worth almost the same value against the U.S. dollar and the euro as it was at the time of our posting (see graph).

Looney Predictions

Originally posted on September 21, 2007

By Scott Ronalds

With the loonie hitting parity with the U.S. dollar for the first time in over 30 years, the forecasters are once again coming out of the woodwork with predictions on the future direction of the currency. Some are patting themselves on the back for correctly calling the loonie’s rapid ascent, while others are back-peddling on prior forecasts and coming out with fresh revisions.

The bullish camp points to strong fundamentals driving the currency higher over the short-term: high oil prices (the loonie is viewed by many as a petro-currency, with its fortunes tied closely to the price of oil), continued demand for commodities, low unemployment, etc. While the bearish camp points to an oversold U.S. dollar, a slowdown in global growth, and a probable cut in interest rates by the Bank of Canada as key reasons why the loonie is likely to lose steam.

So which camp are we supposed to believe? How about neither. Short-term currency movements are really anyone’s guess and are next to impossible to predict. If the loonie is closely tied to the price of oil, where is oil going? Who’s to say that it won’t fall to $50/barrel? Or rise to $100/barrel? If its path depends on the strength of the domestic economy and the interest rate environment, will Canada steam ahead or pull back? You get the picture. There’s too many variables at play. Not to mention that movement in the loonie isn’t entirely correlated to these variables anyways.

If you can’t sleep at night because the loonie’s rise is killing your foreign equity returns, you can consider hedging away some or all of your foreign currency exposure (although it may not be the best time to do so, given the substantial short-term appreciation that you’ve already absorbed). A better solution is to ignore the headlines and accept that currency movements are too unpredictable to gamble on, and tend to balance themselves out over the long term. And while it certainly hasn’t benefited Canadian investors lately, foreign currency exposure actually provides a layer of diversification to your portfolio and can boost your returns. Remember the 1990s?

We all like to have fun with predictions (don’t kid yourself, even the big addresses on Bay Street have 'friendly' pools on where the loonie will close at the end of the year), but it’s not so fun when you jeopardize your portfolio by acting on them and making the wrong call on something that’s entirely out of your control (read currency movements).

That said, I couldn’t end this posting without a prediction of my own, all in good fun of course. So here goes: Seahawks 27 – Bengals 21. Now you can take that to the bank.

We're not a bank.

Which means we don't have to communicate like one (phew!). Sign up for our blog to get the straight goods on investing.