By Scott Ronalds

We last heard from Emmylou around this time last year, when she needed to set aside some money for a ‘sabbatical’ to Europe. She spent the summer exploring and had a rich experience on the continent. She recently checked in on her Steadyhand portfolio and feels richer still – she holds the Founders Fund across all her accounts, which was up 15.9% over the past 12 months (ending October 31st).

Emmylou arranged a call with us earlier this week for a portfolio review. Because she has been a Steadyhand client for less than two years, her performance is still very short term, and we cautioned that she shouldn’t read too much into the numbers.

We discussed the areas of strength over the past year, namely global equities. The Founders Fund has had a bias towards foreign stocks through its holdings in the Global Equity Fund and Equity Fund, which has been a key factor in its performance. The fund’s fixed income component (Income Fund) has provided more modest returns, as interest rates have edged upwards (which has pushed bond prices down).

While pleased with her performance, Emmylou asked how her portfolio has done relative to the markets in general. We provided her with some index returns, and she was able to quickly see that she’s well ahead of a benchmark based on her asset mix.

With performance covered, we turned to the other three P’s: people, philosophy and process. In terms of people, we noted that there haven’t been any notable personnel changes at our fund managers or Steadyhand (notwithstanding the additions of Jennifer and Cheryl to the team). Further, our philosophy and process hasn’t veered, nor has that of our managers. We’re still undexers to the core.

Emmylou questioned whether she should be making any adjustments to her portfolio in light of its strong performance. We reminded her that one of the benefits of the Founders Fund is that we make adjustments to the fund’s asset mix based on our views on market valuations and sentiment. On this note, we explained some of the recent changes to the portfolio: we’ve brought down the weighting in stocks modestly, and edged up the weighting in bonds, while still maintaining a healthy cash reserve. We encouraged Emmylou to read our recent blog, A Lot Has Gone On, which highlights these adjustments in greater detail.

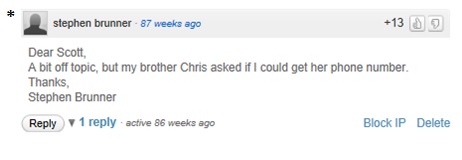

When we asked her if there have been any changes in her personal situation, she happily informed us that she has a new man in her life (sorry Mr. Brunner*). Her job and income are stable and she doesn’t foresee any need to tap into her portfolio over the next several years.

We advised Emmylou that her portfolio remains well positioned for her circumstances and objectives, and she doesn’t need to take any actions. We stressed, however, that she needs to maintain realistic return expectations going forward. Indeed, her portfolio is not going to provide a double-digit return every year. She should be thinking more in the neighbourhood of 4-6%.

Lastly, we encouraged her to come out to our annual client presentation in the Peg in late January (the 27th). She said she’ll be there, as long as the Jets aren’t playing. Priorities.

Management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns.

1We're not a bank.

Which means we don't have to communicate like one (phew!). Sign up for our blog to get the straight goods on investing.