by Scott Ronalds

With the significant climb in interest rates over the past 18 months, you can now get a yield of 5% or more on your cash by investing in a GIC (guaranteed investment certificate) or money market fund. You have to shop around a bit, but it’s not hard to find products offering mid-single digit rates.

The current yield (pre-fee) on our Savings Fund, for example, is 5.19% (as of October 27)*. A quick survey of the GIC landscape reveals a range of rates between 4% to 6% at the banks and credit unions, depending on terms and features.

Keep in mind, comparing GICs and money market funds is an ‘apples-to-oranges’ exercise. I won’t get into the weeds here, but a key benefit of money market funds is their flexibility (you can buy and sell any time without incurring penalties). GICs may offer a higher rate but your money is either locked in for the term of the certificate or there are penalties if you need to redeem prior to the maturity date.

Regardless of your product of choice, it’s been a while since we’ve seen rates this high.

Cash is king ... or is it?

The current environment has some investors wondering whether it still makes sense to invest in riskier assets like stocks and bonds, given their inherent volatility. Cash is king, in other words.

An all-cash portfolio can be a good option for people with a short time frame, ultra-low tolerance for risk, and/or more money than they’ll ever need. For most of us, however, stocks still represent the most effective growth engine in our portfolios. Investing in corporate America (and Canada and Europe) has proven to be a winning strategy over time, significantly outpacing the returns provided by cash. And bonds, despite their recent weak performance, offer diversification and stable income, as well as a winning record over cash.

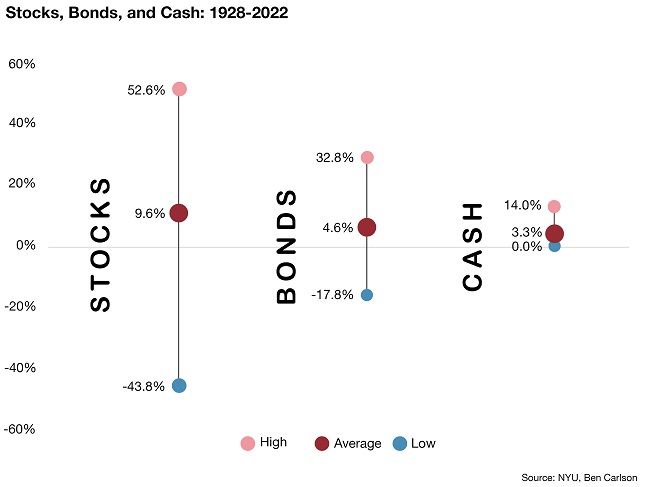

Put more simply, long-term investors should expect stocks to beat bonds, and bonds to beat cash. The relative return outlook for these asset types hasn’t changed.

Ben Carlson (an American portfolio manager and writer) provided a good visual of this relationship earlier this year, which I’ve recreated below. Over the past 95 years, stocks returned 9.6% on average, bonds 4.6%, and cash 3.3% (as measured by the S&P 500 Index, 10-year U.S. Treasuries, and 3-month U.S. T-Bills, respectively). Cash, while much less volatile, has clearly been an inferior investment over the long haul.

Further, if interest rates turn course and start to decline, bonds will enjoy a favourable tailwind (when rates fall, prices rise) and stocks will benefit from a lower discount rate (which means future earnings are more valuable in today’s dollars). Cash-like investments, on the other hand, will see their yields squeezed.

To be clear, we’re not saying interest rates will decline. They’re more normal today than they were two years ago, and the current consensus is ‘higher for longer’. If inflation continues to come down and the economy cools, however, lower rates are certainly possible. And in the meantime, a mix of government, corporate, and high yield bonds provide a much better income stream today than over the past several years.

A final consideration if you’re thinking that cash is the place to be for the time being: getting back into the market is extremely difficult. Indeed, it’s the hardest decision in investing (as we point out in this report).

Final thoughts

Today’s yields on savings products are attractive and welcomed by savers who have endured a decade and a half of measly returns. If you need to hold some cash in reserve, you should be sure to take advantage of the competitive GIC rates and money market funds available to you.

But while princely, the return on cash is still no substitute for assets better geared to provide your portfolio with long-term growth — namely stocks, and yes, bonds.

*Management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The indicated rates of return are the historical annual total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns.

We're not a bank.

Which means we don't have to communicate like one (phew!). Sign up for our Newsletter and Blog and join the thousands of other Canadians who appreciate the straight goods on investing.