This article was published in the November 2016 edition of MoneySense Magazine. It is being reprinted with permission.

by Tom Bradley

Not happy with your returns? If you’re looking for someone to blame you may want to try the mirror. I’ve spent the last decade trying to figure out the best way to deliver investment management to individual Canadians. What I’ve found is no matter how much careful thought goes into constructing a low-cost portfolio, there is no way to account for the biggest swing factor—investor behaviour.

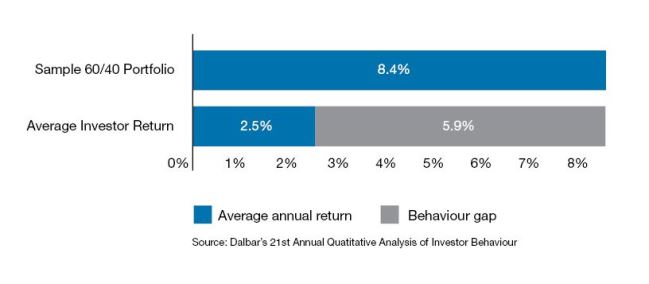

Study after study confirms what I see on the front lines—investor returns are considerably worse than the returns of the products they invest in. Indeed, Dalbar, a U.S. research firm, did a study looking at 20-year returns to December 2014. It showed that a simple mix of 60% U.S. stocks and 40% bonds generated a return of 8.4% per year, while the average investor had a return of 2.5%. Carl Richards, a financial educator and personal finance writer for the New York Times, named this shortfall the ‘Behaviour Gap’.

There are many factors that contribute to the gap. Fees and commissions are part of it. Investors’ propensity to trade too much (often buying high and selling low) is another. Most portfolios hold too much cash. And perhaps the biggest gap widener is investor action at extreme points in the market cycle. Making significant changes to a portfolio at euphoric or gloomy moments can devastate long-term returns.

Just how big is your behaviour gap? Unfortunately, it’s difficult to figure out, but it’s about to get a whole lot easier. In January, banks and investment dealers will be required to report investment returns to their clients, so you’ll finally get a clear look at how your portfolio is doing. But if you already suspect you’re leaving money on the table, there are some simple things you can do to eliminate the behaviour gap.

Have a plan

It sounds basic, but knowing the purpose of the money and how you’re going to achieve your goal is the most important thing you can do. Investing isn’t a quick run to the corner store, it’s a multi-decade road trip, with winding roads, steep hills and detours to navigate around. It’s imperative that you have a map to keep you on course.

Develop a routine

Most aspects of your life have a pattern to them and investing should be no different. You want it to be as regular and disciplined as you can. That means consistently contributing to your portfolio, no matter what the markets are doing, rebalancing when your asset mix gets out of whack and staying on top of what’s happening with your portfolio and investment provider. Woody Allen said, “90% of success is just showing up.” Investing is like that. It’s not rocket science.

Stop overpaying

Are you paying commissions and fees for advice you’re not receiving? Do you own funds that charge active fees for passive management, or have multiple people doing the same thing? Stop it. Part of effective cost management is understanding the low-cost alternatives, such as ETFs, low-cost mutual funds, discount brokers and robo-advisors, all of which could play a role in your portfolio.

Be prepared for jolts and extremes

There’s no avoiding them. You might as well be prepared because they’re a necessary part of wealth creation. You should know what you’re going to do when stocks are up 30%, or down 20%. Or when a well-known columnist predicts a major crash. None of these things should take you off your plan, but if you’re not prepared, they just might.

Avoid the cash drag

In Canada, the biggest cause of the behaviour gap has been too much cash in portfolios. When investors are busy, or worried or unhappy with their advisor, they tend to leave large amounts of money sitting in the bank. Their do-nothing option is a savings account or GIC. For the money you’ve set aside to invest, however, the answer to being too busy, nervous or unhappy shouldn’t be cash, but rather your long-term asset mix. For example, if your plan calls for a mix of 70% stocks and 30% fixed income, that’s your default position.

There’s lots of blame to go around when your investment returns are disappointing, but you shouldn’t overlook the most important factor of all. You’re the CEO of your portfolio. The buck stops with you.