By Scott Ronalds

Investment Plan. Two words that turn many people off. The whole notion of preparing a plan seems time-consuming, difficult, expensive, complicated. Not to mention boring. It’s easier to put it off, to keep putting money here and there, or to just keep everything in the bank.

But investing without a plan is like facebooking after a few cocktails – you’ll regret it later. Without defining your objectives and laying out a set of disciplines around your investing, your returns are likely to be sub-par and your financial anxiety high. It can have a real impact on your standard of living down the road.

The thing is, an investment plan can be surprisingly simple. In fact, it shouldn’t be overly complex. A key element of a plan that we encourage investors to focus on is determining a Strategic Asset Mix (SAM). A SAM is simply the long-term mix of stocks, bonds and other investments that will give you the best chance of achieving your goals.

Your plan can be six words on a Post-it note: 75% stocks, 25% bonds. Rebalance annually.

It can be a motto: Half my portfolio is invested for growth in stocks, the other half is in bonds to lessen the shocks.

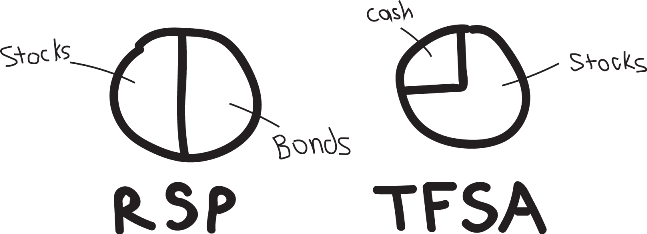

It can be a simple drawing:

Or, it can be a more formal document built with the help of a fee-for-service financial planner. Whatever form it takes, an investment plan can help keep you on track and serve as a valuable tool in times of market excitement and stress. To learn more about formulating a plan, check out our resource on the topic, or give us a call at 1-888-888-3147.