by Tom Bradley

In addition to everything else that happened in 2020, it was the year when everyone started trading stocks. There are all kinds of reasons for this outburst of enthusiasm — no sports betting during the lockdown; big market swings; the steady rise of the tech barons; a love affair with Tesla; and lots of sexy lockdown names like Peloton and DoorDash.

Of course, this phenomenon is cyclical. It’s not a one-time thing. Every so often investment interest and trading volumes explode. The current surge reminds me of the late 90’s when the dotcom stocks were emerging, and discount brokers couldn’t hire people fast enough.

Longer than normal wait times

Discount brokers are in the news again, but not for good reasons. Their customer experience in 2020 was horrendous. In a recent article, Rob Carrick of the Globe and Mail wrote about long wait times and retired investors unable to access their RRIF accounts.

Rob’s article captures a common refrain. We have heard lots of stories and experienced a few. I twice waited over 40 minutes to deal with issues related to my RESP accounts (I count myself lucky after reading Rob’s article).

This situation reminds me of the business adage — Your most important customers are the ones you already have. It seems like many financial firms didn’t read those books. In our sales-oriented society, new customers are treated like gold. The existing ones? Well, not so much.

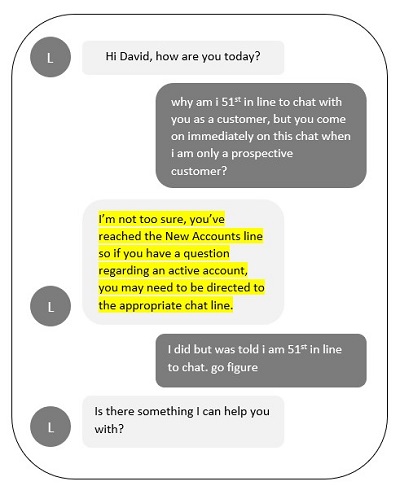

This emphasis is illustrated by an experience our David Toyne had. When he tried to get in touch with a broker, he was #51 in the queue. When he tried again, acting as a prospect, his chat request got an instant response. Below is a screen shot of his chat (re-created for clarity).

The client you already have

I have no quarrel with my discount broker. They have a business to run and I don’t pay them much. But they need to stop telling me that they’re experiencing higher than normal call volumes due to new client sign-ups and transfers. And they need to stop sending me promotions (like they did this week) encouraging me to add a new account in exchange for free money.

I understand the need to grow. Costs go up every year (even when markets don’t) and we all need scale to compete with the banks. At Steadyhand, we work our butts off to expand our client base. But there needs to be a balance between loyal, long-standing clients and fresh, shiny new ones. Right now, the discount brokers are out at one end of the spectrum whereby new customers are getting all the attention (and iPads) while the formerly shiny clients can’t even get money out of their account.

The other extreme would be for firms to only take new clients when they’re able to maintain service levels. This would be ideal, but in most cases, not realistic. The right spot is somewhere in the middle. A balance.

We're not a bank.

Which means we don't have to communicate like one (phew!). Sign up for our blog to get the straight goods on investing.