by Scott Ronalds

Our funds officially reached the decade mark this quarter, which means we have our first set of 10-year performance numbers. We’re excited to share the results with you.

Our goal when we started Steadyhand was to build and manage funds that provide market-beating returns over the long run based on our undexing approach.

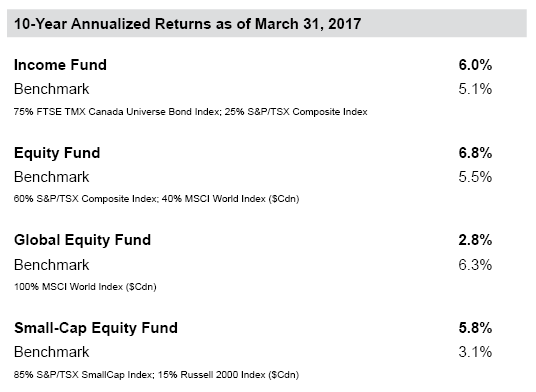

Three of our four original, long-term funds have beat their respective benchmarks over the past decade. We’ve excluded our highly-ranked Savings Fund from the analysis, as it’s a short-term, savings-focused fund. As well, our Founders Fund wasn’t launched until 2012 and thus doesn’t have a 10-year record.

A few things to note: (1) All our returns are after-fee, while the benchmark numbers have no fees included. (2) Clients who invest over $100,000 with us enjoy higher returns thanks to our fee reduction program. Furthermore, our first clients will also start receiving an additional 14% break on their fees as part of our 10-year loyalty discount. (3) Benchmark returns are rebalanced to the target allocation on a quarterly basis.

You’ll note that our Global Fund has lagged. We’re the first to acknowledge this, and have communicated frequently as to why the fund has underperformed, and why we think it’s poised for a turnaround.

So how have longstanding Steadyhand investors fared in general? Our balanced clients whose portfolios resemble our 'model portfolios' have achieved long-term returns ahead of their respective benchmarks.

Another number we’re excited about is Steadyhand’s money-weighted return. This represents the average annual return our clients (in aggregate) have achieved. It takes into account the timing of purchases and redemptions. When compared to our time-weighted return (which doesn’t take into account flows in and out of our funds), it’s a good indicator of whether our clients are sticking to their plans through good times and bad. Our 5-year money-weighted return is 8.3%, while our time-weighted return over the same period is 8.4%. We’ve referenced 5-year numbers because our client base was insufficient in our early years to calculate meaningful 10-year numbers and our funds weren’t available to the public until April 2007.

The difference between the returns a fund achieves versus the returns its investors achieve has been coined the “behaviour gap.” It can be substantial for some firms because of investors reacting adversely to market news, chasing short-term returns, and generally trading too much. We’re thrilled that we don’t have a behaviour gap.

As a Steadyhand client, we thank you for your confidence in our business and your commitment to long-term investing. We hope we’ve met your expectations thus far.

And if you’re not a client, what are you waiting for? We’ll do our best to continue to provide index-beating returns – and a steady hand – over the next 10 years.

Management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The indicated rates of return are the historical annual total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns.

1We're not a bank.

Which means we don't have to communicate like one (phew!). Sign up for our blog to get the straight goods on investing.