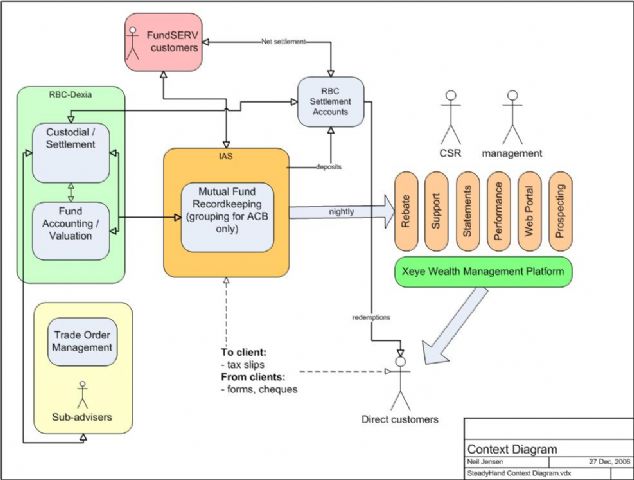

Early on in our business design, we decided to outsource many of the business functions necessary in a mutual fund company. One of the tools we used to visualize how the functions would fit together was a (very loose) variation of a context diagram.

The attached diagram shows most of the major functions and associated systems:

- custodial and settlement services are provided by RBC-Dexia

- fund accounting and valuation services are also provided by RBC-Dexia

- our investment managers use various trade order management systems and RBC-Dexia's Viewfinder application to manage the funds

- recordkeeping services are provided by The Investment Administration Solution (IAS)

- we interact with other brokers and dealers via FundSERV

- there are operating bank accounts (in trust for the funds) for receiving and sending money to clients at RBC

- we use Xeye as our wealth management platform

We rely on our outsourcing partners to provide their expertise and scale. The beautiful part is that our internal operations are simple, and we literally don't own a single server. The downside is that we have to be very diligent in monitoring our providers, and in particular, the various interactions between them.

In future posts I'll dig into each of these functions in more detail.