by Tom Bradley

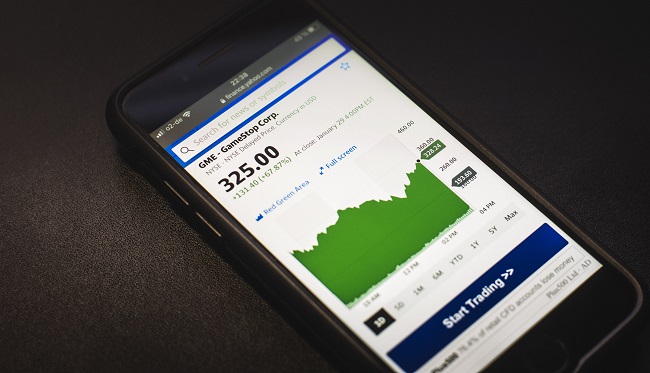

We’ve had some questions recently about GameStop and Blackberry. The price surges in these and other stocks that are being hyped in chat rooms is the talk of the town. If you haven’t followed the story, this New York Times article is a good piece to get you up to speed. We’re not going to rehash what’s been in the press; rather, our purpose here is to provide some perspective and address how Steadyhand clients are being impacted.

Stick it to the man!

First off, we think the ‘little guy bringing down the big, bad hedge funds’ theme is being overplayed. Yes, a handful of hedge funds took a hit because they sold GameStop short, but there are, and will be, many more that profit from the wild price swings. Hedge funds love volatility. It’s what they live for.

The theme is also odd because discount brokers like Robinhood work closely with New York hedge funds. There’s a reason that investors don’t pay commissions for trades. It’s because the brokers sell their trading information, or ‘flow’, to firms that do high frequency trading. These hedge funds pay hundreds of millions of dollars to brokers so they can trade ahead of the clients.

The appropriate adage here is, “If you’re not paying anything for the product, you are the product.”

Motive

We’re not denying that some investors are trading with ‘stick it to the man’ in mind, but the vast majority are doing it for one reason – they’re looking for a big score. These are high risk investments and there are people in the chatrooms who have (very publicly) made gobs of money. Others want a piece of that.

How does it end?

Nobody knows how and when this will end, but we do know that:

-

The odds are against the speculators who are paying more for an asset than what it’s worth, especially when they’re paying several multiples of what it’s worth.

- Having said that, some people will make a big score.

- Many more people will lose money, some losing all of what they invested.

- GameStop and the other stocks involved will eventually be priced based on their future profits and dividends – i.e. what they’re worth as a business.

Looking ahead

Today, the playing field for individual investors is more level than it’s ever been. They get all the same information that the big institutions do and their cost of trading is now very low. On this playing field, however, to build wealth over time it’s as important as ever to have a long-term plan, exercise good judgment and discipline, and keep emotions in check.

How does this all impact Steadyhand clients?

Our fund managers don’t short stocks, nor do they speculate on short-term moves. Their hope with every stock they buy is that they’ll hold it for five years or more. Needless to say, our funds aren’t invested in GameStop or other stocks impacted by the recent fireworks.

This focus on fundamentals and valuation generates attractive returns over the long run, but also means we’ll miss out on some early-stage tech stocks as well as situations like GameStop. It also means we won’t suffer to the same degree when these stocks succumb to gravity, as they inevitably do.

We're not a bank.

Which means we don't have to communicate like one (phew!). Sign up for our blog to get the straight goods on investing.