by Tom Bradley

This year, Steadyhand was a finalist for the award that we most want to win – Morningstar’s ‘Steward of the Year’. In announcing the nomination, Morningstar provided the following background.

"Steadyhand remains the poster child of a good steward. The firm continues to stand out for its transparency, consistent approach to investment management and investor-first orientation. Our nomination is a nod to its efforts in minimizing the behaviour gap -- the oft-large difference between what a fund and its unitholders earn. Investor returns often fall short because of counterproductive behaviour. The political turmoil of 2016 offered such opportunities, but its calm, accessibly-written commentary helped investors maintain their sanity, improving the odds fund holders will stick with their investments over the long haul.

Similarly, when it changed subadvisors at its small-cap fund, Steadyhand clearly outlined its rationale for the change and described differences in approach of the new subadvisor in direct communication with clients and on its website -- a nice change of pace from the formulaic press releases that typically announce manager changes. Such candor shouldn't be uncommon: When fund holders put their capital at risk, they deserve to know who's watching over it and why.

Steadyhand also deserves kudos for disclosing the extent of its employees' investments in the firm's funds. It's not that co-investment is unusual elsewhere, but with 83% of their financial assets invested in the firm's funds on average, Steadyhand employees enjoy the same experience as its clients. It’s worth noting Steadyhand chooses subadvisors to manage its funds, and while the firm showed us how these subadvisors invest heavily in the strategies they oversee, the extent of these managers' co-investment isn't publicly disclosed. Steadyhand employees don't make investment decisions within the funds, though the firm chooses the subadvisors and sets fees. The employees' heavy co-investment aligns these decisions with those of fund holders."

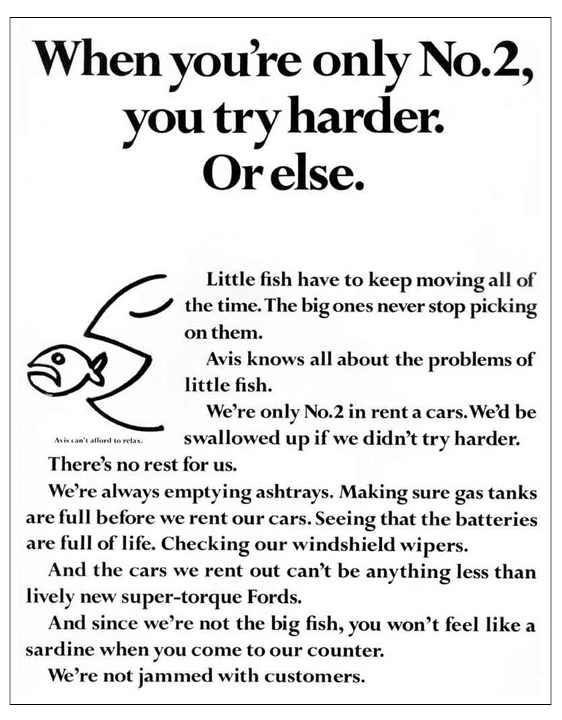

Well, despite these glowing words, we didn’t quite make it. The award went to RBC Global Asset Management. But not to worry, we have every intention of living up to the old Avis motto – "When you’re only No.2, you try harder."