by Scott Ronalds

With the turn of the calendar comes a fresh $5,500 in contribution room for your Tax-Free Savings Account (TFSA). It’s awesome. You can shelter another fifty-five hundred dollars of investments from taxes.

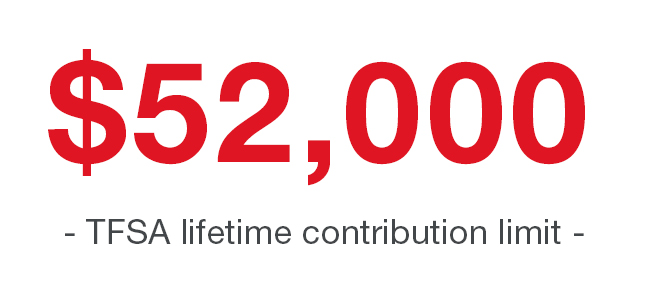

Even better, the lifetime contribution limit for these accounts now stands at $52,000 (for investors who meet all eligibility requirements). What this means is that if you were 18 or older in 2009 and have been a Canadian resident with a valid social insurance number since, you have over $50,000 in contribution room. If you have a spouse or partner who meets the eligibility requirements, your household contribution limit is now over $100,000.

This is big. And if you’ve been adding to your account diligently over the past nine years (including 2017), you could have significantly more in your TFSA when factoring in investment growth. Indeed, we have many clients who have over $70,000 in their accounts.

As a reminder, all the growth in these accounts is tax free, and when you redeem money you don’t pay any tax on it. For those who aren’t certain what type of investments can be held in TFSAs, all of our funds qualify (as do most stocks, bonds and other publicly traded securities for that matter). In other words, these accounts are investment vehicles, not just savings vehicles as their name unfortunately implies.

If you don’t have a TFSA as a part of your overall portfolio and would like help setting one up, or if you’re looking for advice on where to allocate your contributions, give us a shout (1-888-888-3147). These accounts offer a rare tax break that all investors should take advantage of.