This article was published in the December 2016 edition of MoneySense Magazine. It is being reprinted with permission.

by Tom Bradley

“Tom, is this a good time to invest?” With Brexit and the U.S. election dominating the headlines clients are asking me that question a lot more often. My short answer: Yes, you can’t predict how political or economic events are going to impact the markets in the short term - nor should you care. Investing is all about the long game.

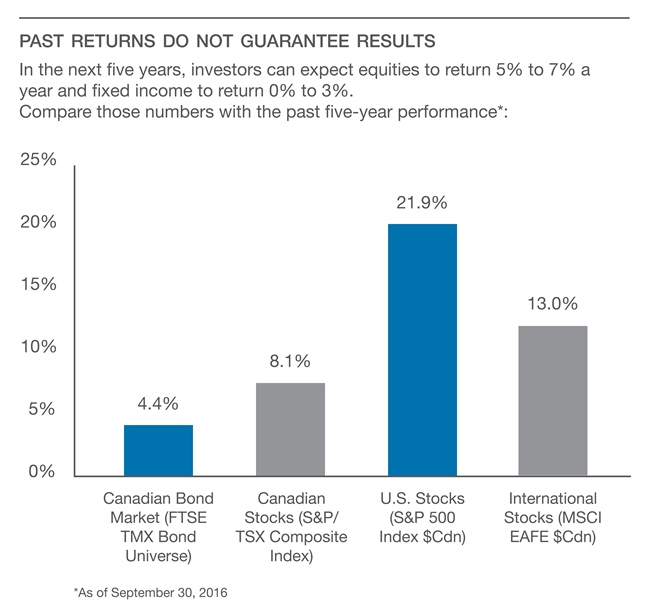

Easier said, given the tone of the prognostications. It’s hard to ignore warnings of lower returns going forward due to subdued economic growth and bloated debt levels. These are complex challenges that the current divisive political environment seems unable or unwilling to resolve. But if lower returns means below the above-average returns we’ve had over the last seven years, that might be OK. The only reason not to invest is if the projected returns aren’t high enough to justify the risk.

Let’s cut through the gloom and deconstruct the expected returns from the two major components of your portfolio: Fixed income and stocks. I’ll start with fixed income. For the past 35 years we’ve been in a raging bull market for bonds. Interest rates have steadily dropped, which has driven prices higher. Not only have fixed-income returns been awesome, they’ve come with almost no downside along the way. This asset class has only experienced three years of negative returns since 1980.

The same can’t be said going forward. I learned early in my career that the best predictor of future bond returns is the current yield. Right now, the overall bond market in Canada (as measured by the FTSE TMX Canada Universe Bond Index) is yielding 2%, so that’s your baseline for the safe portion of your portfolio for the next 10 years. It’s possible to enhance that return by owning riskier bonds, but it will mean some down years and provide less diversification.

The long-term prediction for stocks is much less reliable, but it’s still useful to have a viewpoint to help guide your investment strategy. There are three different sources of return to consider here: dividends, profit growth and the change in valuation.

First up, dividends. On this measure, equities look good. A well-rounded stock portfolio yields close to 3% these days.

Next up, profit growth. Decade after decade, profit growth has averaged 6%, but half that pace seems a more reasonable assumption today. The building blocks of economic growth are not robust, with an aging population in the Western world, weak productivity gains and governments and consumers constrained by heavy debt loads. That’s not to say there won’t be any growth. The trend towards industry consolidation points to higher margins and profitability, plus Europe, Japan and many of the emerging economies have plenty of room to improve.

Now the wild card: change in valuation. Market returns are often driven for long periods by changes in what investors are willing to pay for dividends and profits. In the ’90s, price-to-earnings multiples expanded steadily, resulting in very high returns. The decade that followed saw significant multiple compression, which led to little or no return in many markets. Today, valuations are in a normal range, which suggests this input shouldn’t be as big a swing factor. A move in either direction shouldn’t surprise investors, although if price-to-earnings multiples at the high end of the range there’s a better chance they’ll drop rather than rise.

So what should you expect over the next year or two? I have no idea. There are too many random variables at play. But with the levels of dividends, profit growth and valuation expected over the next five years it would suggest to me a 5% to 7% return from the overall stock market.

Where does that leave you? You’ll need to accept lower fixed-income returns with more volatility. Stock returns may come in below historical averages, but they will still be reasonable, especially if you use weak periods to invest more. A balanced portfolio should earn 4% to 6% over the next five years, meaning $100,000 invested today will accumulate to between $121,500 to $134,000, which is a meaningful premium over inflation and secure, cash-like instruments.

So yes, it is a good time to invest, especially if you are investing for the long term.