We’re changing the way we calculate and report the rate of return on account statements. Effective Sept. 30, 2015, we’ll show your portfolio’s money-weighted rate of return (MWRR) instead of its time-weighted rate of return (TWRR). We have reported the latter (TWRR) since our inception in 2007; more on the difference between the two in a moment.

We’re making the change because the Canadian Securities Administrators (CSA) has mandated that all investment providers report money-weighted returns to their clients starting next summer. We’ve chosen to jump ahead of the curve and make the change sooner.

Put briefly, money-weighted returns take into consideration the impact of your contributions and withdrawals to/from your portfolio and are therefore a more accurate portrayal of your personal investing experience.

Both approaches have advantages and drawbacks. The time-weighted methodology factors out the impact of cash flows (buys and sells) in your portfolio. It therefore makes more sense when comparing your portfolio’s return to that of a benchmark (which also has no cash flows). This method, however, ignores your actions with respect to the timing of buys and sells, as noted above.

While money-weighted returns take into consideration your transactions, this method can be inappropriate for comparing returns against an index, benchmark or other funds, as a timely contribution (e.g. a purchase when the fund is down) or an untimely withdrawal (e.g. a redemption when the fund is down) can have a notable impact on your rate of return. If you place a sizeable transaction in your portfolio, you should therefore be careful when comparing your MWRR to any benchmark.

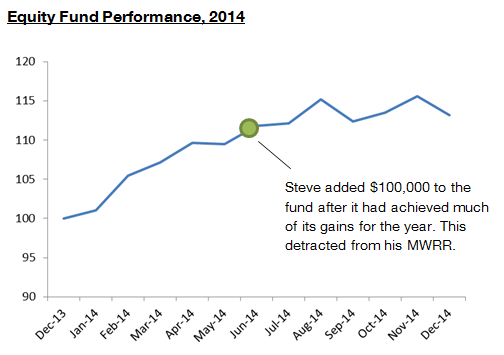

Sound confusing? An example may help clarify. The following scenario considers two investors, Steve and Sheila, who both held the Steadyhand Equity Fund in 2014.

On January 1st, Steve and Sheila both held $100,000 in the fund. On June 30th, Steve purchased an additional $100,000 in the fund. Sheila did not buy or sell any fund units throughout the year. Steve and Sheila’s time-weighted rate of return was identical, 13.2%, because TWRR factors out the impact of cash flows. Since Sheila did not make any transactions in her account, her money-weighted return was the same as her time-weighted return. Steve’s MWRR, however, was 9.7%.

| |

Jan 1 Value | June 30 Purchase | Dec 31 Value | TWRR | MWRR |

|---|---|---|---|---|---|

| Sheila | $100,000 | $0 | $113,180 | 13.2% | 13.2% |

| Steve | $100,000 | $100,000 | $214,415 | 13.2% | 9.7% |

Steve’s lower MWRR is explained by the fact that the Equity Fund had a strong first half of the year (gaining 11.8%), but cooled off in the second half, rising only 1.2%. Because Steve had a much larger sum of money that only earned 1.2% in the second half of the year, his MWRR was lower than his TWRR and was thus a more accurate reflection of his investing experience.

If the fund produced a modest return in the first half of the year and a strong return in the second half after Steve’s purchase, his MWRR would have been higher than his TWRR because he would have had more money invested when the fund was growing the most.

If you wish to dig deeper into the mechanics of the two types of return calculations, we encourage you to read our paper on the topic. And always feel free to call us at 1-888-888-3147.

Management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The indicated rates of return are the historical annual total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns.