By Scott Ronalds

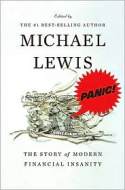

Panic is a compilation of articles that shed light on the most severe upheavals in recent financial history – the crash of ’87, the Russian default and subsequent collapse of Long Term Capital Management, the Asian currency crisis of 1999, the Internet bubble, and the U.S. subprime mortgage crisis.

Although the book is edited by Michael Lewis (the author of Liar’s Poker and Moneyball), the articles were written by various prominent financial journalists/authors including Roger Lowenstein, Paul Krugman, Lester Thurow and Lewis himself. While many of the pieces appeared in publications such as The Wall Street Journal, The Economist, The New York Times, and Fortune, some are excerpts from books written at the time.

As taken from the inside cover, “Some of the pieces paint the mood and market factors leading up to the particular crash, or show what people thought was happening at the time. Others, with the luxury of hindsight, analyze what actually happened.”

I found it particularly interesting, not to mention entertaining, looking back at the articles written in the dot-com era. From the incredible rise and subsequent drubbing of start-ups such as Pets.com, Books-A-Million, and Egghead.com, these pieces do a good job illustrating the euphoria and emotion that can so easily overcome investors.

The last section of the book, which deals with the subprime crisis, also has several well-written articles that help explain how Americans got into the current mortgage mess, where defaults and the phenomenon of ‘negative home equity’ have become all too common. If you’re looking for a plain-English explanation of the emergence and function of complex investment vehicles such as CDOs, SIVs and credit default swaps, the collection of articles that Lewis has chosen are a good place to turn.

Panic is a great read for the patio this summer – assuming that the house connected to that patio isn’t worth less than the mortgage attached to it.