By Tom Bradley

“If the bear leans on you, hold your ground”

Are these words of advice from an investment guru like Buffett, Watsa or Hager? No, they’re instructions from the trainer of Koda, my big furry friend who appeared with me in the video on our original home page. As it turned out, the trainer’s words would quickly become as relevant as any from Warren, Prem or Bob.

In this, the first of five posts celebrating our 5th birthday, I’m going to reflect back on what was by far the biggest feature of Steadyhand’s history - the stock market meltdown and financial crisis that played out in late 2008 and early 2009. This period was the toughest five months of my career, as well as being the most revealing, humbling, encouraging and ... well, amazing.

With the help of my somewhat-steady words from that period (blogs, Globe and Mail articles, quarterly letters), let me take you back.

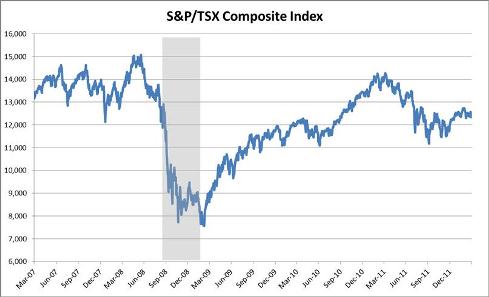

September 30th, 2008 (Blog) - S&P/TSX Composite Index Level 11,753

We would encourage our clients to sit steady and stay positioned for the inevitable recovery. For those who have the stomach, we would recommend further purchases of equities and/or some re-balancing towards those funds.

In the two years leading up to October 2008, I had been cautious about the economy and stock market. Indeed, my biggest fan, Aunt Judy, kept telling me I needed to put more positive stuff in my Globe column. Despite my concerns, however, I didn’t see the capital markets unwinding the way they did. The amount of leverage in the financial system and its impact on investor behavior (panic and forced selling) took stocks and interest rates way lower than I would have thought possible.

So when the Canadian market was down 18% in the third quarter (and 22% from its high), I was already moving into buy mode. As I’ve acknowledged since, I was a couple of months and 20% too early on that first step.

October 3rd (Blog) - 10,803

“You want to be greedy when others are fearful and you want to be fearful when others are greedy. In my adult lifetime, I don’t think I’ve seen people as fearful economically as they are right now.”

My first call was premature, but it’s never too early to draw on words of wisdom from the big guy, Warren Buffett. This quote, taken from a Charlie Rose interview, captured the mood at the time. It felt like the world was melting down and there was nowhere to hide.

October 29th (Blog) - 9,502

A [declining market] often leads to the conclusion that investors must revise downward their future return expectations ... but it is totally wrong-headed. From this low base, portfolio returns will be quite attractive. Good markets are built on a foundation of poor earnings reports, low valuations, wide credit spreads and fearful investors. Three years from now I may be back in the mode of talking down return expectations, but that isn’t appropriate right now.

When markets are plummeting and investors are scared, it’s easy to talk to clients about lowering their return expectations going forward. It’s a ready sound bite, but it’s wrong. After severe market declines, it’s time to expect more from the next few years, not less. I say this because markets constantly overreact to changes in fundamentals. A downward adjustment to a company’s short and medium-term outlook should impact the stock price, but Mr. Market invariably overshoots, especially in emotionally charged times.

December 13th (Globe and Mail) - 8,515

The first three years [of future profits] account for roughly 10% of a company’s value.

As the fourth quarter progressed, earnings forecasts were coming down. Clearly profits were going to take a hit over the next year or two. But as noted in this post, a company’s value reflects a stream of future income (dividends and undistributed profits) of which the early years account for only a small portion. Nonetheless, the market was pounding well positioned, solidly financed companies along with their weaker brethren, which meant the valuation being placed on longer-term profits was significantly cheaper.

My message to the battered and bruised is to start preparing for the other side of the valley. It’s time to get back on plan.

It sounds pat, but the fall of 2008 was a time when investors needed to lean on their long-term plans, not abandon them. In periods of crisis (and euphoria), everyone becomes an economist and wants to take action, but beyond some re-balancing, it’s not the time to make wholesale changes. Bigger changes, if necessary, should be saved for less charged times, hopefully after the portfolio has benefited from the ‘up’ volatility that inevitably follows the ‘down’.

January 8th, 2009 (Quarterly letter) - 9,222

As discouraging as 2008 has been, it is important that we now make rational decisions based on the opportunities and risks we face today. Today, valuations on corporate bonds and stocks are compellingly cheap. Today, market sentiment, which measures how positive or negative investors are, is flashing a ‘Buy’ signal – i.e. bearishness is at an extreme. Today, the de-leveraging of the financial sector is well along. Today, there is a mound of cash on the sidelines waiting to be put to work. Today, the investing environment is very conducive to making money.

Everyone was hurting, but as you can see, I was progressively getting more forceful in my guidance. The ducks were all lining up. Valuations on stocks were screamingly cheap and according to Connor, Clark & Lunn, the manager of our Income Fund, we were looking at a “once-in-a-lifetime” opportunity to buy corporate bonds.

We concluded the Quarterly Report with another quote, this time from Shelby Davis.

“You make most of your money in a bear market: you just don’t realize it at the time”

January 13th (Blog) - 8,962

This isn’t the RRSP season to miss.

We came up with this theme to help personalize our communication. We hoped that a reference to familiar behavior (contributing to an RRSP) would plant our message smack in the middle of investors’ decision-making processes.

The reality is, the RRSP season is a depressingly accurate measure of how most (non-Steadyhand) investors behave. In seasons when the market has previously been good, contributions are robust and targeted at stocks. When markets have been tough, investors allocate money to safe investments, or simply don’t contribute.

I couldn’t think of a better year to break that pattern.

January 24th (Globe and Mail) - 8,628

Based on their valuation models [Edinburgh Partners and Boston-based GMO], expected real returns (after inflation) over the next five to seven years have moved into double-digit territory in most equity classes.

Markets were bouncing around (February was worse again), but my conviction was higher. I wasn’t trying to time the market, but I desperately wanted our clients to take advantage of the opportunity. I can honestly say that this was one of the easier calls I’ve had to make (it’s much harder when valuations and economic signals are more ambivalent). I didn’t expect a V-shaped recovery (which it turned out to be), but was confident our clients would make serious money over the next three years if they acted.

February 19th (Blog) - 8,185

The risk today is not buying cheap equities.

In an extensive interview, Sandy Nairn, the CEO of Edinburgh Partners and manager of our Global Equity Fund, made a compelling argument for buying stocks.

April 9th (Quarterly letter) - 9,187

We have been encouraging our clients to take some ‘baby steps’ in re-balancing their portfolios. Baby steps because we recognize how hard buying stocks is in this uncertain time. Personally, I am continuing to re-balance my portfolio in that direction, although my steps are even smaller because I’m near the top of my equity range. I believe the reward/risk balance is again in my favour, and want Lori and my asset mix to reflect that.

After 5 months of hell, I was feeling beaten up and poorer for it, but also wiser and well positioned. In good times we talk effortlessly about taking advantage of the opportunities that come with recessions and crises, knowing all too well that when the time comes, it’s challenging to do. In this remarkable period, we got it ‘approximately right’. The clients that followed our advice came through 2008 and the subsequent years pretty well.

I don’t expect to see another five months like this again in my career, but for periods like it, I’ll endeavour to be better prepared for the downside and hopefully act just as decisively on the upside.