by Tom Bradley

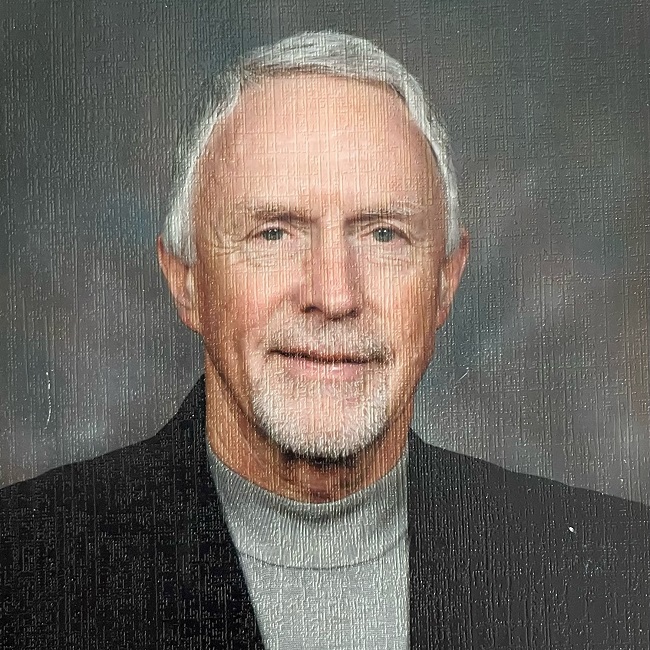

In a speech at the Investment Hall of Fame dinner last year, I referenced my good fortune to be mentored by so many skilled, experienced and giving people. One such person was Tony Hamblin, who I described as "a little-known giant in our industry."

Tony passed away this month to the sadness of those who loved him, including many in the investment field who were influenced and helped by him.

A little history from his obituary: "Tony started his career as an Investment Analyst with Confederation Life and worked there for eighteen years, reaching a pinnacle role as President of Confed Investment Counsel. An entrepreneur at heart he left Confederation life in 1984 to co-found Hamblin Watsa Investment Counsel with Prem Watsa."

Confederation Life (Confed as it was known) produced more great investment managers than any firm in Canada, by a mile, and Tony was at the center of it. Under his early leadership (followed by other strong leaders), many greats emerged including the aforementioned Prem Watsa, Robert Tattersall, and my former colleague, Tony Gage (the Dean of bonds for many years).

But Tony’s influence extended far beyond the team at Confed and Hamblin Watsa, and beyond the investment industry. Again, from the obituary: "Generous to a fault, he never hesitated to take those in need under his wing. He was always supportive of his extended family, nieces, nephews, close personal friends, and their children — mentoring dozens of them. He lent an ear when they were struggling to achieve their goals and a space in his home when they needed a place to live and prosper."

When Neil and I got together to start Steadyhand in 2006, we met with people all over the street. I talked to Tony numerous times, often for wisdom and experience, but just as often for inspiration. He was passionate about entrepreneurs. If you wanted to start something, he was there for you.

Tony said that if we started the firm, the greatest joy would be the "independence". I’ll never forget the sparkle in his eyes when he said independence.

He told us to focus on what we could control: people, philosophy, and business practices (ethics). The rest would take care of itself.

He was unequivocal in his hiring philosophy, which clearly worked. He didn’t hire to fill a position but rather looked for drive, curiosity, and positive energy (he differentiated between people who brought energy versus those who used energy). He wasn’t worried about technical skills. They could be taught.

Of course, my description of Tony as an investment icon is far too limiting. "Tony was an avid adventurer and aviation enthusiast since his teenage years, receiving his private pilot’s license through the Air Cadet Program. He dipped his toes in every ocean in the world and was thrilled to take the opportunity to fly Migs in Russia with his two sons. Never one to be afraid to take risks, and not being satisfied with just flying planes, he became involved in the resurrection of the iconic Found bush plane, becoming Owner and President of Found Aircraft. In his spare time, amongst several other hobbies, he built and flew amateur aircraft, including a scale replica of the P51 Mustang."

I feel privileged to have known Tony, and to have him take an interest in what we were doing. He had a lasting impact. He will be greatly missed.

We're not a bank.

Which means we don't have to communicate like one (phew!). Sign up for our Newsletter and Blog and join the thousands of other Canadians who appreciate the straight goods on investing.