By Tom Bradley

If 2013 was a great year for the markets, it was a stupendous year for pensions.

Aon Hewitt published a report last week that shows the progress pension funds made in 2013 in resolving their funding issues.

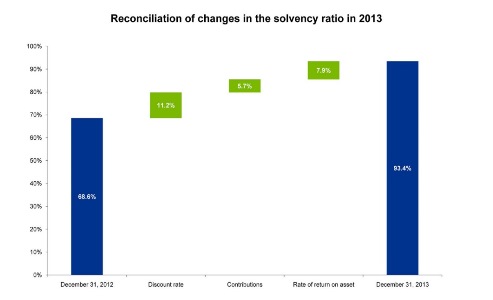

“The latest quarterly survey of more than 275 Aon Hewitt administered pension plans from the public, semi-public and private sectors found that the median solvency funded ratio, or the ratio of the market value of plan assets to liabilities, increased to 93.4% by December 31, 2013. That is a 5.7 point improvement from the end of October 2013 and 24.8 points higher than it was a year ago.”

This should be front page news – going from 68.6% (Headline: ‘Pension Crisis!’) to 93.4% (‘Biggest Economic Win in 2013’) in one year.

In the Aon report, there’s a chart that shows how this happened. The 25 points came from a combination of rising interest rates (11.2), employer contributions (5.7) and good stock markets (7.9).

Higher interest rates reduce the present value of future liabilities. The solvency calculation is highly sensitive to rates, so in a year when the yield on Government of Canada long bonds increased 0.91% from 2.37% to 3.28%, the ratio improved significantly.

Ten years ago we talked about a perfect storm hitting pension funds – declining interest rates (higher liabilities), poor equity returns (lower assets) and a rising Canadian dollar (which further weakened foreign equity returns). 2013 was the opposite of that storm - the 3 variables all turned positive.

This news comes with a few caveats. This is a large sample (275 plans), but the overall pension universe may be different than Aon’s client base. The trend and general magnitude, however, should be the same. And of course, by this measure Canadian pensions are still not fully funded. Only 26% of the plans surveyed have a solvency ratio above 100%.

Nonetheless, this is good for everyone. Those of you with a defined benefit pension plan can breathe a little easier. Your plan is on a better footing. If you have a defined contribution plan or manage your own pension assets (an investment portfolio), the same dynamics apply. The relationship between your assets and future spending needs just got a whole lot better.

On a final note, I’ve not been as worried about pension deficits as many people because the calculations were based on unsustainably low interest rates (in my view). With a return to more normal rates and a renewed commitment by sponsors to contribute, it was clear to me that we would get back on track pretty quickly.

Now just think, if rates go up another 1% and the stock market hangs in, we’ll be fighting again over who owns the surpluses. If we get there, it will be a nice problem to have.