Moves like Jagger: A few thoughts on retirement investing

by Scott Ronalds

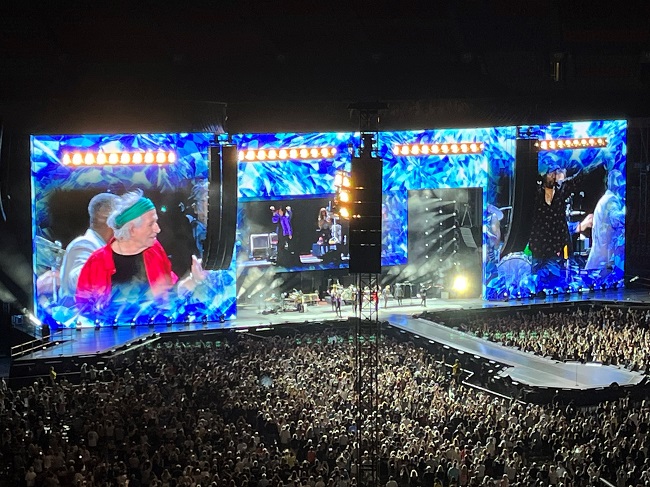

I left the Rolling Stones concert the other week with a new perspective on retirement.

Two rock legends 30 years my senior blew the roof off a packed BC Place Stadium. Mick Jagger, who turns 81 this month, and 80-year-old Keith Richards, who by all accounts should be pickled, put on an unbelievable show. Joined by their long-time running mate Ronnie Wood, the ageless trio played for over two hours and sounded great on a memorable Vancouver night (Midnight Rambler was a highlight). Whatever the Stones are taking, I want some of it. On second thought, maybe I don’t.

Appropriately, the tour was sponsored by AARP (the American Association of Retired Persons). We all know that retirement isn’t what it used to be: a gold watch at 65, company pension, lawn bowling on Thursdays, Jeopardy at 7:30, rinse and repeat. It’s a much more dynamic, and hopefully lengthy and rewarding phase of life now.

Better medicine, advancements in artificial joints, and a more youthful mindset mean we’re living longer, more active lives. The flip side is that we need to finance it all.

Which brings me back to my first thought. The old philosophy on retirement investing is, well, old. A rule of thumb used to suggest that you should hold your age in bonds. In other words, if you’re 75, three-quarters of your portfolio should be in fixed income (and the rest in stocks). This may be suitable for some people, but for many, it’s bad math. An overly conservative asset mix runs the risk of your investments drying up prematurely.

Your retirement portfolio should reflect your individualism. If you’re in good shape and have good genes, you’ll need your investments to continue to grow well into your 90’s if you intend to rely primarily on your portfolio to provide you with an income. You’ll require a healthy dose of stocks to achieve this. Of course, you have to be comfortable with the level of risk you take on, but holding the bulk of your assets in bonds or cash could limit your returns, and the lifestyle you’re able to live.

If you’re like me and have a 15- to 20-year runway (or longer) before dialling down the day job, you should make sure you’re giving your portfolio its best shot at growth. Regular contributions and a heavy weighting in stocks is my advice (although everyone is different, and you should speak to your advisor to determine a plan suitable for your circumstances).

These are just a few things to think about if you’re planning for or are new to this phase of life. I’ll report back after Jagger and crew’s Centenarian tour.

2024 Mid-Year Review

The first six months of the year was a strong period for stocks. That said, returns continue to be driven by a narrow group of equities, the 'Magnificent 7'. In fact, over the past 24 months, just seven tech-related stocks accounted for over half of the market's return. This has had two important outcomes: the market is not as well diversified as it previously was, and investors are facing a greater temptation to veer from their plans due to a fear of missing out (FOMO). We provide additional context on the current environment and offer advice for investors in our mid-year review video below.

Latest Blogs

Latest Prices

Contact Us

Full Site