By Tom Bradley

“It’s not volatility itself that generally leads to poor longer-term performance, but rather it appears to be investors’ emotional reactions to volatility that ultimately lead to poor performance.” – Richard Bernstein, Richard Bernstein Advisors, New York

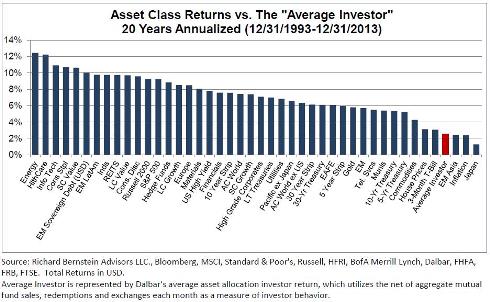

This is an excerpt from Mr. Bernstein’s August letter (thanks to my friend Ryan Balgopal at RBC Phillips, Hager & North Investment Counsel for the lead). He backs his comment up with this unbelievable chart.

Over this 20-year period during which the S&P 500 had an annualized return of over 9% (13th bar from the left) and a 10-year Treasury bond earned 5.5% (9th from the right), the ‘Average Client’ return was 2.5% (Yikes … 4th from the right). Unbelievable indeed. A combination of fees and poor investor/advisor decisions (buy high, sell low) has created this gap.

This chart reinforces why we’re doing what we’re doing at Steadyhand. We care intensely about portfolio management, fund design and fair fees, but the most important thing we can do for our clients is provide a steady hand.

So far, management, design and fees have translated into fund returns in excess of the market indices (it won’t always be the case), but what we’re most pleased about is that our clients have stuck to their plans, stayed fully invested and as a result, participated every step of the way.

The tag line for Mr. Bernstein’s company, Uncertainty = Opportunity, is something we strongly agree with. For investors to move to the left side of the chart, they need to embrace volatility, not be fearful of it.

1We're not a bank.

Which means we don't have to communicate like one (phew!). Sign up for our blog to get the straight goods on investing.