by Scott Ronalds

Electric vehicles are the future, despite a recent slowdown in sales. They’re better for the planet, have fewer parts and lower maintenance costs (no oil changes, less brake wear), and offer excellent performance. Governments are also mandating their increased adoption.

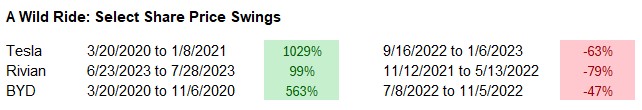

To no surprise, they’ve piqued the interest of investors in recent years. Tesla has a legion of fans and has generated enormous returns for early shareholders. Yet, many investors have also been burned. Indeed, the stock is still down more than 50% from its 2021 high. The same can be said of Rivian (the high-end maker of trucks and SUVs) and BYD (the Shenzhen-based firm that for a brief time overtook Tesla as the world’s top-selling battery electric vehicle manufacturer).

To say that EV stocks are volatile is an understatement. Because of the excitement and hype around the prospects of an enduring shift towards electrification, there’s been speculation around the stocks at times that has led to big share price swings. Investing in the sector is made more challenging by the fact that the manufacturers require significant amounts of capital, profit margins are erratic, and demand has shown signs of inconsistency (Tesla and BYD recently reported disappointing sales figures).

Yet the EV story is compelling, nonetheless. Many investors are focused on picking the company that will win the race (Tesla, Rivian, BYD, Hyundai, or one of the other emerging players), hoping their bet will pay off. But there’s another, arguably safer, way to participate in the industry’s growth: seek out best-in-class suppliers of parts and components.

One such company is Michelin. The French firm with the famous mascot is the technology leader in tires for electric vehicles, and is consistently recognized as one of the world’s most reputable brands. EVs are more demanding on tires because of their heavier weight and faster acceleration. Michelin has developed solutions to address these issues (its tires offer a high load capacity, the lowest abrasion rates, and low rolling resistance) and 8 out of 10 EV manufacturers use its tires as a result.

Michelin stands to benefit from the overall growth in the EV market, regardless of which firm comes out on top. It’s a more stable business (than the EV makers) and has a 135-year history of innovation and profitability. Granted, it’s not going to grow at the pace of a Tesla or BYD, but it’s a steady cash generator with a lower level of risk.

We own Michelin in our Global Equity Fund, which means you also own it if you hold our Founders Fund or Builders Fund. The EV race is sure to be a fascinating one, with more twists and turns to come, and we’ll be watching with interest. (As a side note, 20% of our staff own an EV.) Our money, though, is on the wheels that make it go round.

We're not a bank.

Which means we don't have to communicate like one (phew!). Sign up for our Newsletter and Blog and join the thousands of other Canadians who appreciate the straight goods on investing.